Savings, lets face it its boring and most of us don’t really do it very well. I know i whittle away a lot of my hard earned cash on convince products like melas at work, coffee shop coffee and take out. Why do we do it. The answer is obvious it is because it is easy, convenient and largely automated. Some one has made it for you. Online banking has made things easier, but the ultimate solution is automation. This is where Plum come in.

ENTERS PLUM

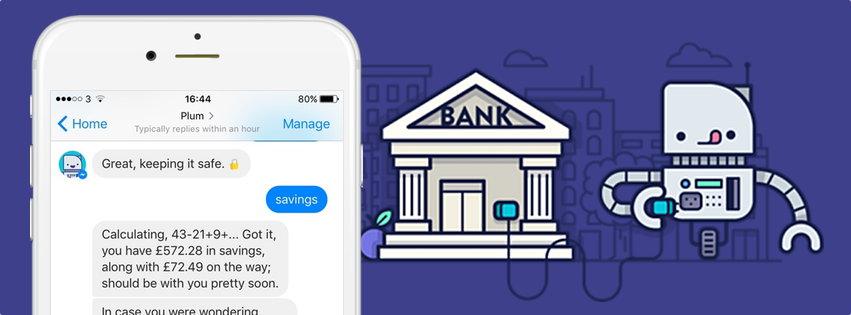

Plum will analyse your earnings and spending, to figure out how much you can save without going overdrawn. The algorithm recalculates your numbers every day, to make sure it adapts to your latest patterns.

HOW PLUM WORKS

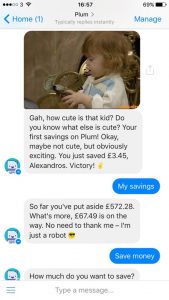

The idea is that you can “micro save” in a way in which you barely notice. Plum does this by looking at your last 3-12 months spending and predicts how much you can afford to save now and in the future.

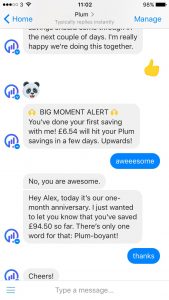

Plum sends you regular Facebook Messenger messages to update you on the state of your savings and give you even more money saving tips. The savings are held under your name, so they are safe and can’t be used by Plum for their operations.

The developers say Facebook messenger is an appropriate way to deliver a saving assistant, not only because messaging apps are where Plum’s target users already congregate, but also because Plum is largely a background process. Why ask users to download an app when most of the heavy lifting takes place outside of the Plum UI.

Save with Plum